What Does Eb5 Investment Immigration Mean?

What Does Eb5 Investment Immigration Mean?

Blog Article

Excitement About Eb5 Investment Immigration

Table of ContentsThe Of Eb5 Investment ImmigrationHow Eb5 Investment Immigration can Save You Time, Stress, and Money.What Does Eb5 Investment Immigration Do?The 9-Second Trick For Eb5 Investment ImmigrationSome Known Facts About Eb5 Investment Immigration.

While we strive to offer exact and current content, it needs to not be thought about lawful suggestions. Immigration laws and laws undergo change, and individual circumstances can vary commonly. For personalized assistance and legal suggestions concerning your specific immigration scenario, we highly recommend talking to a certified migration lawyer who can give you with customized support and make certain conformity with present legislations and laws.

Citizenship, via financial investment. Presently, as of March 15, 2022, the quantity of investment is $800,000 (in Targeted Work Areas and Rural Areas) and $1,050,000 in other places (non-TEA areas). Congress has accepted these amounts for the next 5 years beginning March 15, 2022.

To qualify for the EB-5 Visa, Investors should develop 10 permanent U.S. jobs within two years from the date of their complete investment. EB5 Investment Immigration. This EB-5 Visa Demand ensures that financial investments add straight to the U.S. work market. This applies whether the tasks are developed straight by the business or indirectly under sponsorship of an assigned EB-5 Regional Facility like EB5 United

The Ultimate Guide To Eb5 Investment Immigration

These tasks are determined through versions that use inputs such as development expenses (e.g., building and tools costs) or annual profits created by ongoing operations. In comparison, under the standalone, or straight, EB-5 Program, only straight, full-time W-2 worker positions within the company might be counted. A key risk of counting exclusively on direct employees is that staff reductions because of market problems might cause insufficient full time settings, possibly causing USCIS denial of the investor's petition if the job production demand is not satisfied.

The financial version then forecasts the number of direct work the brand-new company is likely to create based upon its expected earnings. Indirect tasks determined via financial models refers to employment generated in sectors that provide the items or solutions to the business straight associated with the project. These work are created as a result of the enhanced demand for products, products, or solutions that support business's operations.

The Basic Principles Of Eb5 Investment Immigration

An employment-based 5th preference classification (EB-5) financial investment visa provides a method of ending up being a permanent united state resident for international news nationals really hoping to invest funding in the USA. In order to make an application for this copyright, an international financier has to spend $1.8 million (or $900,000 in a Regional Center within a "Targeted Work Location") and create or preserve a minimum of 10 full time work for USA employees (excluding the financier and their prompt family).

Today, 95% of all EB-5 funding is elevated and invested by Regional Centers. In lots of areas, EB-5 investments have filled up the funding gap, providing a new, essential source of funding for neighborhood financial growth projects that rejuvenate neighborhoods, create and sustain work, facilities, and services.

What Does Eb5 Investment Immigration Do?

More than 25 countries, consisting of Australia and the United Kingdom, use comparable programs to bring in international financial investments. The American program is a lot more rigorous than several others, requiring significant threat for financiers in terms of both their original site financial investment and immigration condition.

Households and people that seek to move to the United States on a long-term basis can use for the EB-5 Immigrant Capitalist Program. The United States Citizenship and Immigration Services (U.S.C.I.S.) established out various demands to acquire permanent residency through the EB-5 visa program.: The very first step is to find a certifying investment chance.

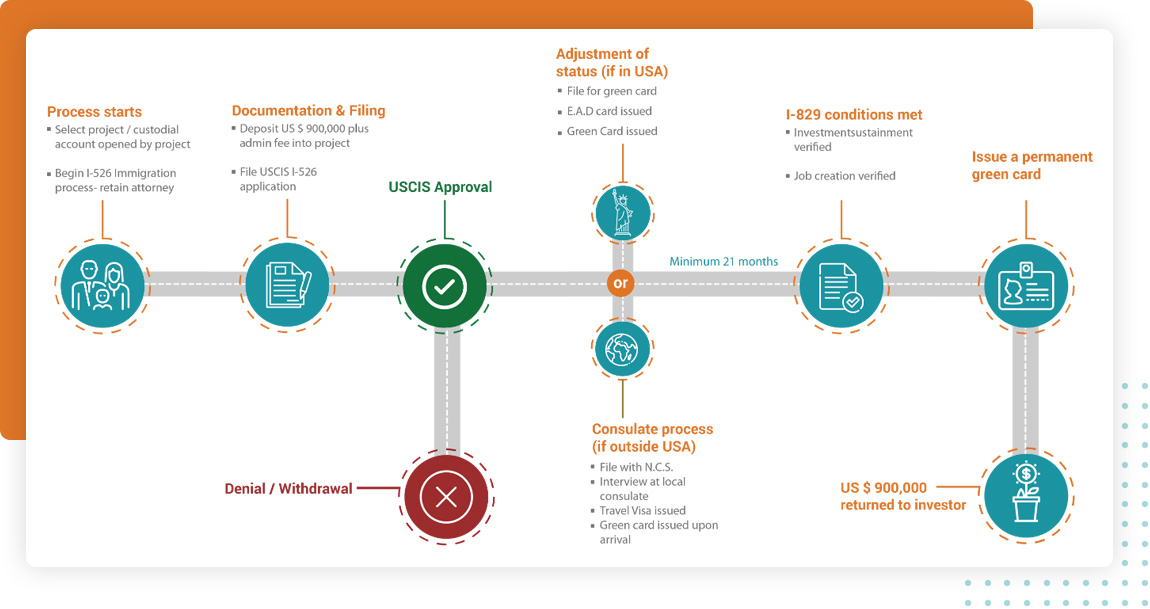

When the possibility has been determined, the financier should make the investment and send an I-526 request to the united state Citizenship and Immigration Services (USCIS). This request must consist of evidence of the financial investment, such as bank statements, purchase contracts, and company strategies. The USCIS will review the I-526 request and either accept it or demand added evidence.

The smart Trick of Eb5 Investment Immigration That Nobody is Discussing

The capitalist needs to obtain conditional residency by submitting an I-485 petition. This application should be sent within six months of the I-526 authorization and need to consist of evidence that the financial investment was made which it has created at the very least 10 permanent work for U.S. workers. The USCIS will examine the I-485 application and either authorize it or request additional evidence.

Report this page